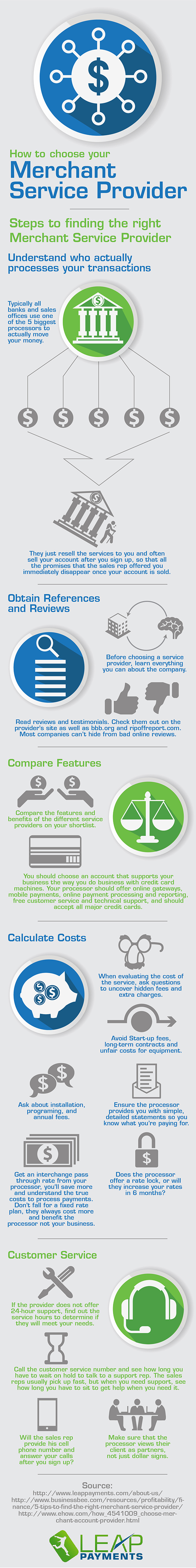

Below is an infographic provided by Leappayments.com -- they contacted me a long, long time ago about featuring this on my blog and it managed to get lost in my inbox for quite a while. Every now and again, I would pull it up and look at it and think to myself that, yes, it was a nice infographic.

And since it features information that, for the most part, I have already written about in various posts, I thought this might act as a handy reminder. So, here it is, compliments of Leap Payments, with whom I have no working relationship, and therefore cannot vouch for the company beyond this excellent presentation.

I will caution only one thing with regard to the infographic. It suggests that you pay attention to online reviews, which you should -- but it does not go into detail about how a very small number of rather loud or disgruntled merchants might give very bad reviews of a company that are because of situations where the merchant was at fault. I've read enough such reviews to be able to recognize them, but most merchants and potential agents probably have not. Trusting bad reviews or outstanding reviews blindly is not a good thing -- always look for reviews that give a balanced view of the experience, back up the conclusion with good examples and otherwise tell something more about the company. Neither a few bad reviews nor a few good ones are likely to tell an accurate picture of a company. Additionally, negative reviews (especially on Rip Off Report) are much more common than positive reviews overall, because people having a good experience are less likely to feel the need to write a review in the first place. After all, why would anyone go out of their way to say, "Company X is doing exactly what they are paid to do," which is essentially what every good review would be saying. It's a service, people! Expect it to work properly and be a good value for the money!

The truth about credit card processors and the sales agents who love them

Pages

Friday, October 16, 2015

Monday, September 28, 2015

The Chips Are Down

By now, most consumers who use credit cards have found that replacements for their old plastic have arrived with embedded chips in them. And most merchants have been receiving a barrage of calls for months from processing companies trying to convert them using the need for new chip-enhanced terminals as a selling point. A recent article in the NY Times highlighted the issue. This is a real thing that merchants and consumers alike need to pay attention to as the United States catches up to most of the rest of the world regarding the security of credit and debit payment systems.

Why This Is Important

Fraud protection is one of the main reasons that the chip is an important addition to the credit card. Stripes contain easily duplicated magnetically encoded information about the card and the card holder. For this reason, it has been very easy for criminals to steal this information using a small swiping mechanism and subject consumers to identity theft. These tiny devices have been embedded in the payment terminals built into gas station pumps, or used by waiters or waitresses at restaurants who take the card in order to swipe it in a payment station out of view. There are plenty of ways that the information can be stolen off of a magnetic stripe. But not so easily from a chip.

The main reason is that the chip is actually a small computer with encoded data that must communicate with a distant server in order to authorize the charge or debit. It does this by changing its code every time it is used. This may sound complicated, and it may take a second or two longer than swiping a magnetic stripe does, but it offers a nearly impossible to steal or duplicate transaction process. This is why card brands adopted the chip years ago virtually everywhere else. The USA is always a bit slow to catch up on this sort of technology due to the heavy regulations in place for all things financial and the reticence of major companies to engage in huge spending upgrades any earlier than they have to. But the benefits are going to be huge with regard to identity theft.

What This Means To Merchants

The basic thing that merchants need to be aware of is that they will now be responsible for identity theft issues that come from using duplicated magnetic stripes. If a cardholder provides a striped card, the merchant must verify the cardholder's identity or risk being liable for the transaction. This should be standard protocol anyway, but the processing companies are offering cheap or free upgrades to chip-enabled terminals to specifically avoid the costs associated with identity theft and they are going to be very serious about ensuring that merchants use this new tool. On the flip side, the protections involved with chip-based transactions should be higher than the old ones were with the stripe-based transactions.

Tuesday, September 22, 2015

Here is a useful guide to the essentially current Interchange Rates for those of you looking to assess actual hard costs of processing. Keep in mind that the rates do fluctuate several times per year, and that these are the hard costs from the card brands themselves, not including the costs of processing as added by the actual processor or bank you are doing business with (either in the form of markup percentages, fees or a combination of some sort).

For a complete list of US interchange rates, please visit the Visa and MasterCard websites below:

http://usa.visa.com/download/merchants/Visa-USA-Interchange-Reimbursement-Fees-2015-April-18.pdf

http://www.mastercard.com/us/merchant/pdf/MasterCard_Interchange_Rates_and_Criteria.pdf

For a complete list of US interchange rates, please visit the Visa and MasterCard websites below:

http://usa.visa.com/download/merchants/Visa-USA-Interchange-Reimbursement-Fees-2015-April-18.pdf

http://www.mastercard.com/us/merchant/pdf/MasterCard_Interchange_Rates_and_Criteria.pdf

Current Interchange Rates in the United States

| Visa Debit | MasterCard Debit | ||

| Debit Retail Swipe |

Debit Retail Swipe |

||

| Visa Debit CPS | 0.800 % + 15¢ | MC Debit | 1.050 % + 15¢ |

| Visa Debit CPS Regulated | 0.050 % + 22¢ | MC Debit Regulated | 0.050 % + 22¢ |

| Visa Debit Prepaid | 1.150 % + 15¢ | MC Debit Prepaid | 1.050 % + 15¢ |

| Visa Debit Business | 1.650 % + 15¢ | ||

| Visa Debit Business Regulated | 0.050 % + 22¢ | ||

| Debit Keyed |

Debit Keyed | ||

| Visa Debit Keyed CPS | 1.650 % + 15¢ | MC Debit Keyed | 1.600 % + 15¢ |

| Visa Debit Keyed CPS Regulated | 0.050 % + 22¢ | MC Debit Keyed Regulated | 0.050 % + 22¢ |

| Visa Debit Keyed Prepaid | 1.750 % + 20¢ | MC Debit Keyed Prepaid | 1.760 % + 20¢ |

| Visa Debit Keyed Business | 2.450 % + 10¢ | ||

| Visa Debit Keyed Business Regulated | 0.050 % + 22¢ | ||

| Visa Credit Retail Swipe | MasterCard Credit Retail Swipe |

||

| Visa CPS Retail | 1.510 % + 10¢ | MC Consumer | 1.580 % + 10¢ |

| Visa Rewards Traditional | 1.650 % + 10¢ | MC Enhanced | 1.730 % + 10¢ |

| Visa Rewards Signature | 2.300 % + 10¢ | MC World | 1.770 % + 10¢ |

| Visa Rewards Signature Preferred | 2.100 % + 10¢ | MC World Elite | 2.300 % + 10¢ |

| Visa Corporate | 2.100 % + 10¢ | MC Corporate | 1.900 % + 10¢ |

| Visa Business | 2.200 % + 10¢ | ||

| Visa Purchasing | 2.400 % + 10¢ | ||

Visa Keyed |

MasterCard Keyed |

||

| Visa Keyed CPS Retail | 1.800 % + 10¢ | MC Keyed Consumer | 1.890 % + 10¢ |

| Visa Keyed Rewards Traditional | 1.950 % + 10¢ | MC Keyed Enhanced | 2.040 % + 10¢ |

| Visa Keyed Rewards Signature | 2.700 % + 10¢ | MC Keyed World | 2.050 % + 10¢ |

| Visa Keyed Rewards Signature Preferred | 2.300 % + 10¢ | MC Keyed World Elite | 2.950 % + 10¢ |

| Visa Keyed Corporate | 2.950 % + 10¢ | MC Keyed Corporate | 2.650 % + 10¢ |

| Visa Keyed Business | 2.950 % + 20¢ | ||

| Visa Keyed Purchasing | 2.950 % + 10¢ | ||

| Real Estate & Property Management | |||

| MC Real Estate Consumer | 1.100 % | ||

| MC Real Estate Enhanced | 1.100 % | ||

| MC Real Estate World | 1.100 % | ||

| MC Real Estate World Elite | 2.200 % | ||

| MC Real Estate Corporate | 2.650 % + 10¢ | ||

| Charities | |||

| MC Charity Debit (non-regulated) | 1.450 % + 15¢ | ||

| MC Charity Credit | 2.000 % + 10¢ | ||

| International | International | ||

| Visa International | 1.100 % | MC International | 1.100 % |

| Visa International Premium | 1.100 % | MC International Keyed | 1.600 % |

| Visa International Corporate | 2.000 % | ||

| Visa International Keyed | 1.600 % | ||

| Association Fees |

Association Fees |

||

| Visa Card-Brand | 0.1300 % | MC Card-Brand (Under $1000) | 0.1100 % |

| Visa NAPF (Network Acquirer Processing Fee) | 1.95¢ | MC Card-Brand (Over $1000) | 0.1300 % |

| Visa Clearing Access | 0.25¢ | MC ALF (Acquirer License Fee) | 0.0045 % |

| MC NABU (Network Brand Usage Fee) | 0.185¢ | ||

| MC Account Status Inquiry (on $0 auth) | 2.500¢ | ||

| Visa International Cross-Border | 0.8000 % | MC CVC 2 Authorization Fee | 0.250¢ |

| Visa Intl Acquirer Service Fee | 0.4500 % | MC AVS Authorization Fee | 1.000¢ |

| Visa FANF (Fixed Acquirer Network Fee) | MasterCard Intl Cross-Border Support | 0.4000 % | |

| Visa FANF - Card-Present Per Location | $2/mth | MasterCard International Cross-Border | 0.8500 % |

| Visa FANF - Keyed Volume $1,000 - $3,999 | $7/mth | ||

| Visa FANF - Keyed Volume $4,000 - $7,999 | $9/mth | ||

| Visa FANF - Keyed Volume $8,000 - $39,999 | $15/mth | ||

| Visa FANF - Keyed Volume $40,000 - $199,999 | $45/mth | ||

Subscribe to:

Comments (Atom)